|

Posted: 7:00 a.m.

Sunday, Feb. 15, 2015

FOCUS ON TAXES

Half of Butler County

school districts see drop in property values

By http://www.journal-news.com/staff/rick-mccrabb/" rel="nofollow - Staff Writer

BUTLER COUNTY —

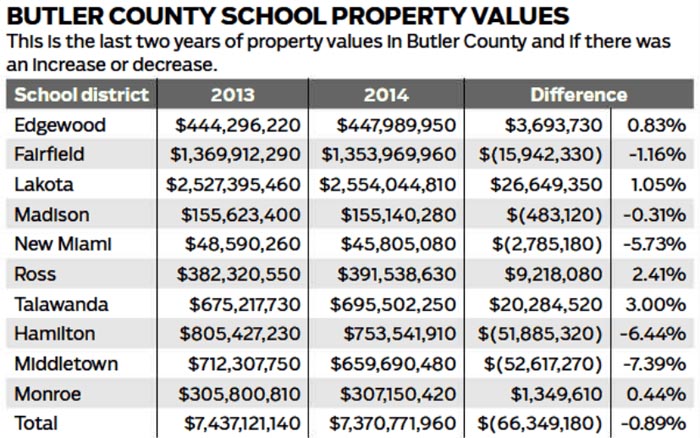

Half of the Butler County

public school districts saw a drop in their appraised property values last

year, and now the districts will have to deal with a substantial loss of tax

revenue.

The value of the property last year,

compared to 2013, dropped $66.3 million, or .89 percent, said Julie

Joyce-Smith, real estate manager for the Butler County Auditor’s Office. Five

districts experienced these losses even though the value of the county’s

agricultural land rose nearly $48 million, or 27 percent.

Joyce-Smith said she’s “cautiously

optimistic” that the property values in the county will increase next year

because she’s seeing a rise in county building permits and hopes that’s a sign

construction is bouncing back.

School districts receive tax revenue from

agricultural, residential, industrial and commercial properties and public

utilities. Values from 2014 will be billed this year, the auditor’s office

said.

Of the 10 public schools districts in the

county, Hamilton and Middletown

experienced the largest drop in property values, particularly in residential.

In Hamilton,

the district’s property values last year dropped $51.9 million, or 6.4 percent,

from 2013. Hamilton’s

residential values dropped $48 million from 2013 to last year.

Bob Hancock, the district’s treasurer, said

the financial impact on the general fund is “insignificant” because the

effective tax rate will be increased to counter the decrease in taxable value

and the district will collect approximately the same amount of taxes.

He said the permanent improvement fund,

which has 3.5 mills that flow into it, will experience a reduction as a result

of the valuation decrease. The annual loss in revenue for the permanent

improvement funds will be $181,000. The annual revenue into the permanent

improvement funds from local taxes is approximately $2.6 million.

He said the loss of $181,000 won’t have “an

immediate impact” on the district.

Decreases

in valuation can also make the district look poorer in the state funding

calculation and that generally leads to additional state funding, Hancock said.

Determining exactly what that translates

into in terms of state funding is dependent upon how assessed valuation is used

in the calculation going forward and Hamilton

is likely to be receiving a capped amount, he said.

Meanwhile in Middletown, values dropped $52 million, or

7.39 percent, from 2013 to last year. The values in residential properties in Middletown fell $50

million from 2013 to 2014.

The two largest gains were seen in heavily

agricultural districts, Talawanda and Ross. Talawanda property values rose $20

million, or 3 percent, while Ross jumped $9 million, or 2.4 percent, according

to the county.

The drop in property values is a trend in Middletown. District

Treasurer Randy Bertram said for the sixth consecutive year, and eight out of

the last nine years, property values in the district fell.

He said that means the district will

receive $1.3 million less in property tax revenue over the next two years —

$500,000 less during the current fiscal year that ends June 30, 2015 and an

estimated $800,000 less in property tax revenue the following fiscal year, he

said.

“Money is tight,” he said, “and we are

watching it closely.”

To

help offset the loss of tax revenue, Bertram said the district isn’t replacing

staff with full-time employees, but long-term substitutes for the remainder of

the school year. The district also is assessing its staffing to determine the

needs for next year.

He said the district also is reviewing

current purchased services and deciding if the service is needed, can be

reduced, and looking for alternatives to reduce the contract costs.

Now, Bertram said, the district’s five-year

forecast will be updated, and the district will take any “necessary actions”

for this and the next fiscal year. He said the district may have to make

adjustments to assure it ends the fiscal year in the black.

Just 10 years ago, Bertram said, the

property values in the city exceeded $1 billion. Since then, there have been five

significant drops: 6.62 percent in 2007; 11.94 percent in 2009; 8.22 percent in

2010; 7.89 percent in 2011 and 7.39 percent last year, he said.

Overall,

since 2005, the district has seen a drop of 39.4 percent in property taxes,

Bertram said.

“I can only hope that we are at the bottom,”

he said.

Bertram said Middletown is $15 million under funded by the

state, according to the formula. He said the state is considering raising the

cap districts can receive. He said if the state raises the cap by 5 percent,

the Middletown

district would receive $1.7 million more for fiscal year 2016.

“We certainly are hopeful,” Bertram said

about the state possibly increasing school funding.

Even if that occurs, Bertram said, the Middletown district would

be under funded in 2019.

Madison

saw a drop off about $483,120 in its property taxes, which will cost the

district about $12,000 to its general funds. Treasurer Rich Natiello said that

was not “a material amount” of money.

He said Madison, and all districts throughout the

state, are eagerly anticipating the state budget, expected to be released in

June.

In the six categories, agricultural saw the

largest increase in property value. The value of farm land in the county went

from $175.8 million in 2013 to $223.8 million last year. Only

the Fairfield

district saw a drop in the value of its agricultural land.

Property taxes on farmland are skyrocketing

because a combination of economic and crop-price conditions have affected state

calculations designed to keep working farms from being taxed as possible subdivisions,

according to the Ohio Department of Taxes. The

so-called Current Agricultural Use Value (CAUV) formula, which was adopted in

the mid-’70s, has historically kept appraised values on cropland at a small

fraction of its market value.

Active cropland in the county was appraised

at an average of about a quarter of its market value from 1996 through 2013,

data from the Ohio Department of Taxation shows.

Now the CAUV will set the farmland value at

two-thirds of market value.

Ten years ago, the average property value

of an acre of farmland was $123, said Shelley Wilson from the Ohio Department of

Taxes. Now, she said, it’s $1,668. She said the value of farmland is getting

“caught up” after years of being undervalued.

The sharp rise, according to experts, is a

result of high crop prices during recent years and continued historically low

interest rates. Both result in higher CAUV values, and thus higher property tax

bills, officials said.

As for residential values, local Realtors

had a difficult time explaining the sharp drop in values.

Michael Combs, manager of Coldwell Bank

Oyer Inc., said he was surprised by the drop of property values in the county,

particularly in Middletown.

He said prices of homes have “gone up a couple of ticks.” He said business is strong

and Realtors and homeowners are “happy and proud” of real estate sales, and

that wasn’t the case two or three years ago.

Paul Renwick, president of the recently

formed board of Realtors from Butler

and Warren counties, said there is “good stock” of homes in the area. He said

property values have “dipped a little” and he doesn’t know why that happened.

|