Right time to invest in US stock market?

Printed From: MiddletownUSA.com

Category: Middletown Area Business

Forum Name: Middletown Area Businesses

Forum Description: News, Information from and about area businesses

URL: http://www.middletownusa.com/forum/forum_posts.asp?TID=3801

Printed Date: Feb 16 2026 at 4:25pm

Topic: Right time to invest in US stock market?

Posted By: Tamar

Subject: Right time to invest in US stock market?

Date Posted: Apr 14 2011 at 7:38am

|

Replies:

Posted By: John Beagle

Date Posted: Apr 14 2011 at 8:04pm

|

I think there will be a pause in the market due to QE2 funding ending.

I would make a wish list of stocks to buy, and wait for a pull back to invest. I have an investment website where I discuss some of my buys, sells, puts and calls in stocks and etfs. If you are interested please visit: http://stockbanter.com/ - http://stockbanter.com/ ------------- http://www.johnbeagle.com/" rel="nofollow - John Beagle Middletown USA News of, for and by the people of Middletown, Ohio. |

Posted By: acclaro

Date Posted: Apr 14 2011 at 9:30pm

| Mr. Beagle, so you are one of the future speculators driving up crude to $7.00/gallon? Shame/ shame. Kidding of course. |

Posted By: Tamar

Date Posted: Apr 15 2011 at 3:53am

| "John Beagle" I visited your website. it is packed with good info. Keep it up will help to many people. |

Posted By: Hermes

Date Posted: Apr 15 2011 at 11:46am

|

According to Pat Robertson everyone needs to put their money in oil & gold. He predicts oil to hit >$300 per barrel and gold to hit >$1,600 an once. He is excited and so am I !! He is excited because he will make $millions,I'm excited because if oil gets that high I'll be Amish. Anyone know where I can buy a good horse ?

------------- No more democrats no more republicans,vote Constitution Party !! |

Posted By: John Beagle

Date Posted: Apr 15 2011 at 5:33pm

|

Funny guy. lol ------------- http://www.johnbeagle.com/" rel="nofollow - John Beagle Middletown USA News of, for and by the people of Middletown, Ohio. |

Posted By: John Beagle

Date Posted: Apr 15 2011 at 5:33pm

|

Thanks allot! ------------- http://www.johnbeagle.com/" rel="nofollow - John Beagle Middletown USA News of, for and by the people of Middletown, Ohio. |

Posted By: John Beagle

Date Posted: Apr 15 2011 at 5:34pm

|

I think Oil has too much downside risk right now. ------------- http://www.johnbeagle.com/" rel="nofollow - John Beagle Middletown USA News of, for and by the people of Middletown, Ohio. |

Posted By: Mike_Presta

Date Posted: Apr 15 2011 at 11:53pm

I believe the next one is scheduled for early in May. ------------- “Mulligan said he ... doesn’t believe they necessarily make the return on investment necessary to keep funding them.” …The Middletown Journal, January 30, 2012 |

Posted By: Tamar

Date Posted: Apr 16 2011 at 2:30am

Yes, therefore waiting for some good news from Oil industry. |

Posted By: TonyB

Date Posted: Apr 16 2011 at 9:31am

| Tamar - the only good news the oil industry is looking for is the price continuing to climb and troubles in oil producing areas. By the way, had the Federal government simply cut oil industry subsidies, they would have cut $40b off the budget deficit without doing anything else!!! Anyone want to justify an industry making record profits and getting government subsidies? |

Posted By: Hermes

Date Posted: Apr 16 2011 at 12:02pm

How could there possibly be a downside to a multi-billion dollar industry with guaranteed profit ?? Like TonyB said,$40 billion in subsidies from our illustrious & charitable government plus what we pay at the pump and the only downside I see is my car only gets 22 mile to the gallon. ------------- No more democrats no more republicans,vote Constitution Party !! |

Posted By: Hermes

Date Posted: Apr 16 2011 at 12:07pm

I need a buggy too,I know where I can get an Amish built buggy for about $2500.Of course thats a stripped down model,no tail lights,no carpeting,just AM & FM radio.Anyone know what the city reg's are for keeping a horse in the backyard ? ------------- No more democrats no more republicans,vote Constitution Party !! |

Posted By: John Beagle

Date Posted: Apr 16 2011 at 12:40pm

|

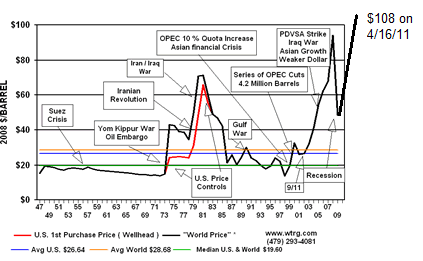

A number of things can happen to make oil drop like a stone.

1. With fuel costs still on the rise, Sen. Robert Menedez again called upon President Barack Obama to release 50 million gallons of oil from the nation’s strategic petroleum reserves. 2. Thanks to new technology the Bakken Formation in North Dakota could boost America’s Oil reserves by an incredible 10 times 3. Stronger US dollar will reduce the cost of oil, so if and when the fed gets off its duff and tightens the money supply, we might see lower oil prices. 4. One of the biggest factors in high oil prices, according to many experts, is that investors, such as hedge funds and investment bankers, can use loopholes in commodities law to manipulate the market and drive crude oil, heating oil, gasoline and diesel fuel prices to new heights. When new highs are reached, investors sell and shell short to crash the market to start over again. Savy investors make money on the way down by shorting the stock or selling calls or buying puts.

Crude oil prices behave much as any other commodity with wide price swings in times of shortage or oversupply. I'm waiting for another drop to invest.

------------- http://www.johnbeagle.com/" rel="nofollow - John Beagle Middletown USA News of, for and by the people of Middletown, Ohio. |

Posted By: TonyB

Date Posted: Apr 16 2011 at 3:26pm

|

Mr. Beagle, I believe you'll be waiting a VERY long time for oil to drop in price. Frist of all, the FED will not be tightening the money supply. Releasing the Strategic Oil Reserve is just plain stupid. A rise in price does not constitute an emergency. When this country is not receiving oil from abroad, then we might need to release the reserve. Could, maybe and might is just as bad as the speculation on oil currently so there is no relief in supply. The whole "crash the market" ethic (or lack thereof) is the rich preying on the poor. And please, don't give me that "but it's legal" bs, because it is WRONG!!! You want to invest in something? I'd say food would be the way to go because if the rich have there way, they'll try to corner the market on that, too! At least then you won't starve!!! |

Posted By: John Beagle

Date Posted: Apr 18 2011 at 12:21pm

|

Oil lost more than $2 a barrel Monday as another move by China to slow its booming economy and a stronger dollar pushed prices down...

Source: http://www.whsv.com/nationalap/headlines/Price_per_Barrel_of_Oil_Down_as_China_Tried_to_Slow_Economy_120067419.html ------------- http://www.johnbeagle.com/" rel="nofollow - John Beagle Middletown USA News of, for and by the people of Middletown, Ohio. |

Posted By: TonyB

Date Posted: Apr 18 2011 at 12:26pm

| Saudi Arabia also cut production in the last month by 800,000 barrels per day. |

Posted By: John Beagle

Date Posted: Apr 18 2011 at 2:11pm

|

OPEC Says No Shortage of Oil, Price Has Premium of $15-$20

By Robert Tuttle and Dahlia Kholaif - Apr 18, 2011 6:45 AM ET Oil officials from Kuwait, the United Arab Emirates, Iran joined Saudi Arabia, the world’s biggest crude exporter, in saying there is no shortage of fuel in the market. http://www.bloomberg.com/news/2011-04-18/opec-says-no-shortage-of-oil-price-has-premium-of-15-20-2-.html ------------- http://www.johnbeagle.com/" rel="nofollow - John Beagle Middletown USA News of, for and by the people of Middletown, Ohio. |

Posted By: arwendt

Date Posted: Apr 22 2011 at 10:01am

|

On a slightly related note:

I heard a interview on NPR a few weeks ago. The guest mentioned that the energy policies of the current administration have directly lead to a cut in the nations overall energy supply of about 10%. FAIL! ------------- “Sell not virtue to purchase wealth, nor Liberty to purchase power.” Benjamin Franklin - More at my http://wordsoffreedom.wordpress.com/ - Words of Freedom website. |

Posted By: TonyB

Date Posted: Apr 22 2011 at 10:46am

An anonymous guest suggests something and it's a fact? First of all, the current and previous administrations are directly to blame for this; not to mention the Congress. Presidents from Nixon on have been saying we need a comprehensive energy policy yet nothing has happened. Now that the addiction to oil is becoming increasingly more expensive, will anyone step up and provide leadership on this? I hear a lot of talk and I see a lot of finger pointing but I don't see anyone offering a real solution other than "fracking" for natural gas. I agree with you about your FAIL assessment but you don't spread the blame nearly far enough.

|

Hermes wrote:

Hermes wrote: